Is it financially better to buy a home or to rent? The answer to this question depends upon how much the home costs,

how much you are paying for rent, and how much you will have to pay each year in order to maintain your home.

If you were to pay $2,100.00 per month, for example, and the average rental payment increase was 4.000%, you would

pay $199,037.02 in a 7 year period toward rent. If you purchased a home and borrowed $315,000.00 with a 4.375%

interest rate, and you paid $1,500.00 every year toward its maintenance, you would pay $186,010.88 in a 7 year period

toward mortgage payments if your Federal tax rate is 28.000%, you pay $3,900.00 in taxes each year and your annual

insurance rate is $950.00.

When you consider your tax benefits and the appreciation of your home, however, you will actually SAVE money by

purchasing a home. If your home shows an annual appreciation of 4.000% and your selling cost is 7.000%, your house

appreciation value will be $460,576.12. As a result, your total home purchase benefit will amount to $175,620.30.

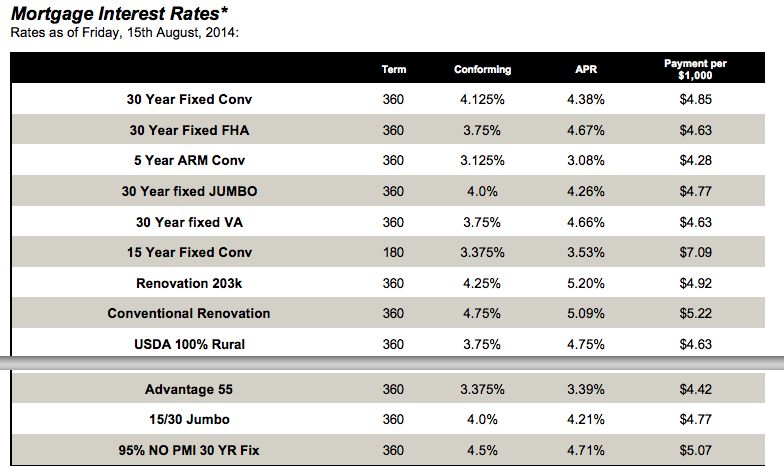

Mortgage Interest Rates for August 15th, 2014 provided by Prosperity Home Mortgage.

*Rates are subject to change due to market fluctuations and borrower’s eligibility. Payment amounts do not include amounts for taxes and insurance. Actual monthly payment could be higher.

For professional use only. Not intended for consumer distribution.

*Rates are subject to change due to market fluctuations and borrower\’s eligibility. Payment amounts do not include amounts for taxes and insurance. Actual monthly payment could be higher. For professional use only. Not intended for consumer distribution.

(c) 2014 Vantage Production, LLC. All rights reserved.